Are Payday loans safe for U.S. residents or should you consider alternatives?

A payday loan is an element of short-term borrowing in which the lender extends a loan at a high interest rate in relation to your earnings. They are also referred to as cash or check loans. Payday loans charge the highest interest deposits for a short-term immediate loan.

How exactly do payday loans work?

Cash advances have become staggeringly popular in the U.S. According to the Consumer Financial Protection Bureau (CFPB), in 2015, 36 states had more payday lending locations than McDonald's locations in all 50 states without exception. Payday loans are made at payday loan stores or at locations that sell other financial services, including check cashing, secured loans, rent-to-own, and sureties, according to state licensing requirements.

Payday loans have all the chances of actually being much more costly than they look at first glance, because these types of loans are specialized for people who need live money immediately, as long as they are waiting then to be re-paid. Loans for the most part cost 405% APR or substantially more. Fiscal fees range from $17 to $34 to borrow $100.

The Bureau of Economic Security informs people that 77 percent of payday loans cannot be repaid within the term specified in the contract. With web borrowers, the condition is formed worse. This entails that the interest cost rises rapidly and the payment you owe rises, making it really impracticable to liquidate it. If the payday loan and the proper fees are not paid in due time, the payday lender can deposit the customer's check. There are phenomena that the user does not have enough financial resources in the deposit to repay the cash advance. According to the loan rules, you will become submitted to a collection agency or debt collector, and these agencies can report you to the debt reporting company.

What does it make sense for me to stockpile before I apply?

To make a loan you will need:

- Any document given by the state authorities and certifying your person with a photo

- Income information from your place of employment

- You must submit a public insurance number

- A working cell phone that you can call anytime

- The account number of the created and active checking account must be active for at least 30 days.

National regulation of the MCA

In 2017, the Office of Consumer Financial Security made a series of changes to requirements to help underwrite borrowers, including requiring payday lenders, which the office calls "small dollar lenders," to recognize whether borrowers can authorize themselves to purchase a loan with an interest rate of 390%. The legislation contained a rigorous notion of underwriting, the proper for lenders to assess a borrower's ability to repay the loan and still pay the day-to-day costs of living before the loan is disbursed. But the Trump administration rejected the argument that consumers need protection, and the CPFB repealed the underwriting law in 2020.

Payday loans at multi-digit rates and with undivided repayment on the second payday are considered legitimate in states where lawmakers have either repealed the small loan adjustment or exempted payday loans from classic small loan or usury provisions and/or approved a bill approving loans based on the presence of the borrower's check or by electronic payment from a bank account.

Payday loans are not permitted for active duty military personnel and their dependents. The laws in addition establish the longevity of the loan time - in specific cases it is only 10 days - but in some states there are no quotas for the loan period. Later on we may experience a greater degree of management of this kind of financial security.

It is imperative that a norm be established that provides additional protection for borrowers. At the same time, different and transparent methods of trade lending must be organized. Congress and the states are additionally working on stricter protections, including the introduction of a 35 percent interest rate cap for all states. The few counties that allow payday lending have the biggest impact, usually between $300 and $800.

Creditworthiness rank in the power to regress if you take payday loans

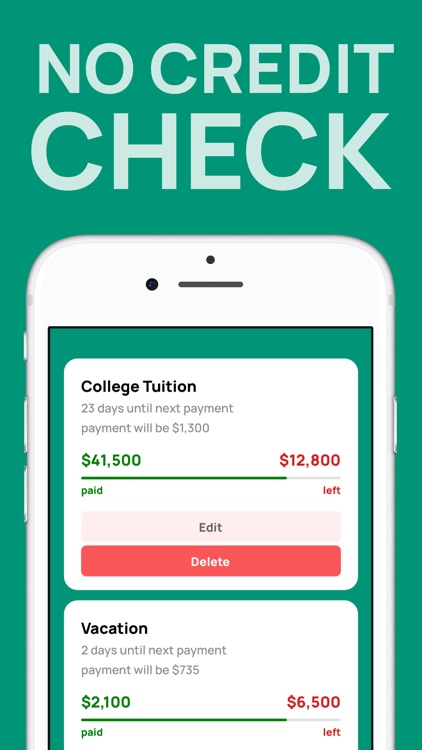

A standard payday loan does not need to find out your ability to pay back the loan or verify your ability to pay back the funds. Payday lenders generally don't perform a credit check on applicants, accordingly the appearance of the application will not be reproduced as a solid request on your credit report, and they won't bother to inform the credit information agencies as soon as you get it. They also more often than not don't show any information about your payday loan history to American banking societies. Although, in accordance with Experian, these loans in addition can't help you adjust your debt rating, in case they aren't reported to the debt transaction bureau if you pay them by the due date.

Meanwhile, everything changes when the account is made delinquent. Just in case you don't pay off your debt and your creditor transfers or sells your payday loan obligation to a collection firm, maybe the collector is able to notify one of the big national credit firms about the loan. In this case, it will still hurt your debt history. When it does, it will stay on your credit account for seven years and will have a bad effect on your credit history. Bank scores are summed up by a few all kinds of credit bureaus based on the information the office focuses on people. Due to not paying off debts on time, your scores will drop, which can have a significant impact on your future loans.

What U.S. citizens need to pay attention to before borrowing a payday loan

Surveys prove that 13 million American customers get payday loans each year, disregarding many indications that they are driving the bulk of people who take out loans into significantly substantial debt. Although people who have gotten payday loans are usually unaware that they have the ability to borrow finances anywhere else, there are options they have the ability to reckon with.

- Consider an opposite payday loan (PAL)

The following variations of a payday loan or PAL allow members of some national credit societies to borrow not very large amounts of money at a significantly lower cost than classic payday loans, and to pay back the loan over a longer period of time. You can use PAL money to your advantage, either to avoid getting a payday loan or to cancel a current one. PALs are managed by the state administration of credit coalitions, which organized the initiative in 2011. The highest interest rate for PALs is 32%, which is barely one-thirteenth of the cost of an average payday loan. In 2017, NCUA acquired the next type of PAL, known as PALs II, which has similar rules. Also, credit associations are prohibited from prolonging PALs, and this determines that people who have received a loan with a minimum likelihood have every chance of getting into a predatory debt cycle. Borrowers are allowed to take out only 1 type of PAL in parallel.

- Borrow cash from family or friends.

Loaning money from your own can be a huge reason in certain situations. On the off chance that you have your back against the wall and a loan from a loved one is the most conscious way to get out of a lousy economic situation, borrowing financial resources may be your best bet. But borrowing from your loved ones in turn can be a double-edged sword. It makes a macro strain on your relationships and can cause guilt, resentment and loss of faith.

- Explore variations in other sources of income

On the off chance that you have more free time, very possibly you can turn that time into pocket money by moonlighting additionally. You can earn extra cash by wanting to sell your clothes, working for a vehicle rental firm, or turning your favorite occupation into an online store. However earning more finances is more elementary to say than to do, there are lots of web opportunities outside of the global web as well. Beware of posts, which urge you to contribute funds or request your own or monetary statements.

Is it possible to get a payday loan without a bank account?

Yes. The existence of a financial account is not always necessary in order to borrow money, but lenders who do not require it mostly charge high fees. Yes, and you should assure in spite of everything that you have a paycheck, then to liquidate the loan. Payday lenders have the ability to ask for a bank deposit, but sometimes a prepaid card deposit may be enough to qualify for a loan. Not all lenders offer this loan plan, which is why you will want to do some research to find the right lender for you.

If only the lender approves your request for debt and you don't have a bank account to calculate repayment, you will in all likelihood have to perform the concept to make the payment directly by check, money order, cash. It's better to liquidate the temporary loan before its liquidation deadline, due to the fact a cash loan will axe expensive totals for failing to meet the repayment time.

Getting a payday loan is obviously more difficult, and even if a lender goes to work with you, they may need many times more data and documentary evidence before they feel sufficiently protected to give you funds. The lender will very likely want to make sure that you have no unopened bankruptcy proceedings, current accounts, or existing tax obligations to your state. Without a deposit, you are, in most cases, cut off by short-term loans, such as quick payday loans with bad credit or loans secured against property.